tax deductions for high income earners 2019

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. For 2022 your additional premium based on income is as follows.

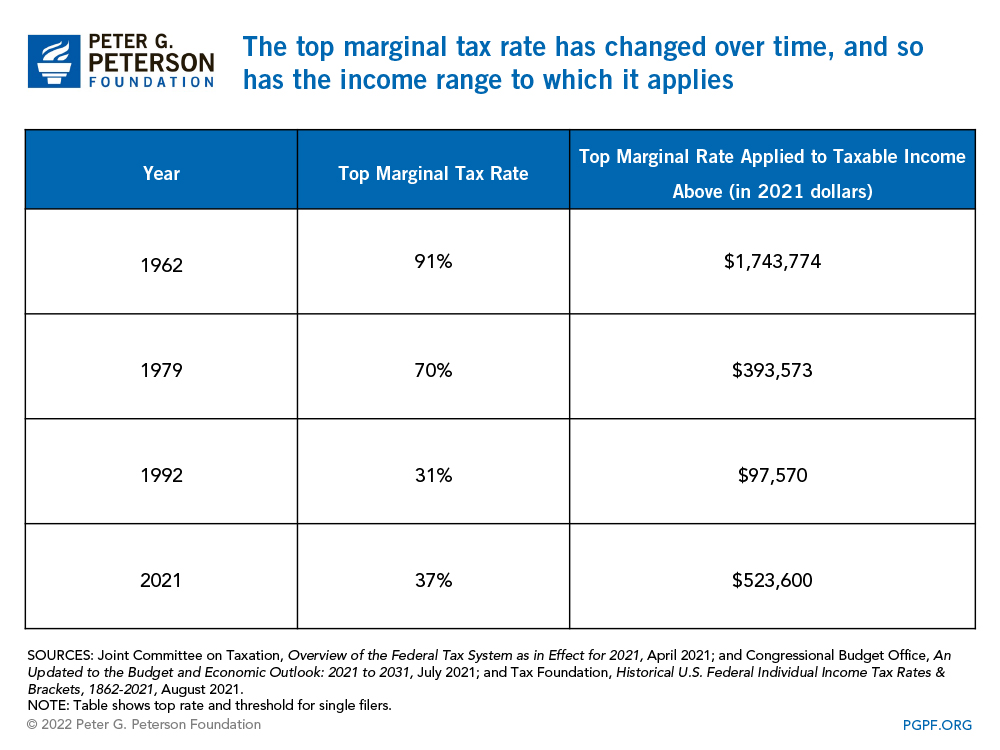

How The Tax Burden Has Changed Since 1960

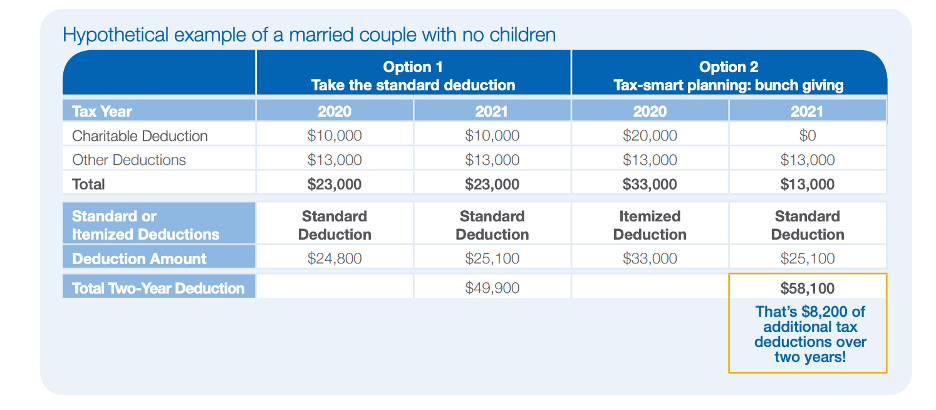

If youre charitably inclined charitable contributions can provide outstanding tax benefits.

. The article below was updated on Dec. The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly. Theyre contributing 1300 to.

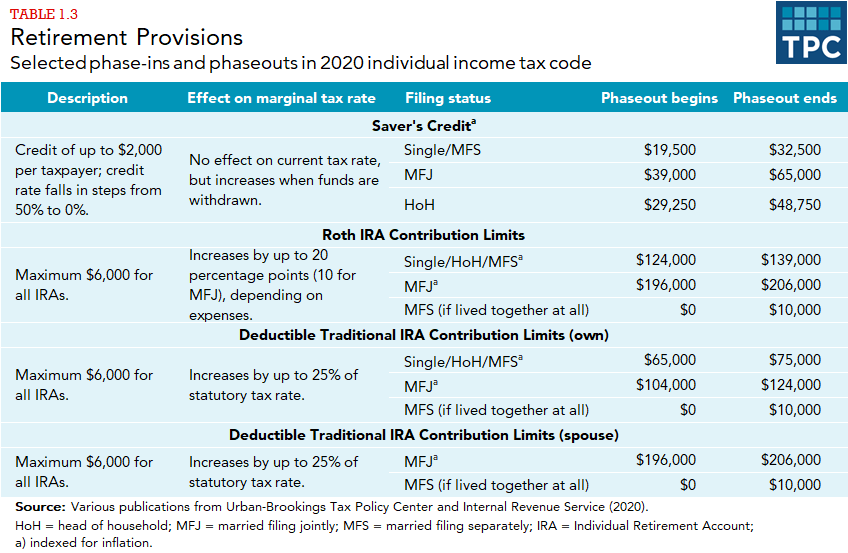

The maximum tax-deductible contribution for a traditional IRA in 2022 is 6000 if youre younger than age 50. For 2018 the limit is 18500 or 24500. For example in 2020 we plan to deduct all of the.

Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. Contributions to a qualified retirement plan such as a traditional 401 k or 403 b. If you are expected to pay IRMAA SSA will notify you that you have a higher Part D premium.

Establish a donor-advised fund. The SECURE Act. 1 2019 the maximum earnings that will be subject to the Social Security payroll tax will increase by 4500.

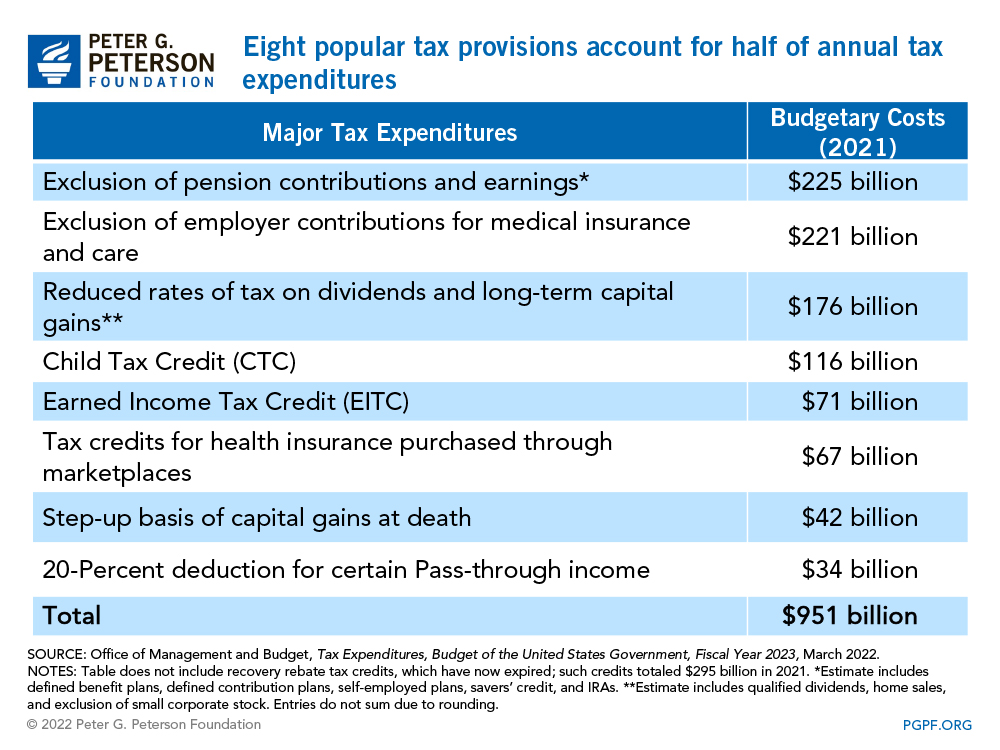

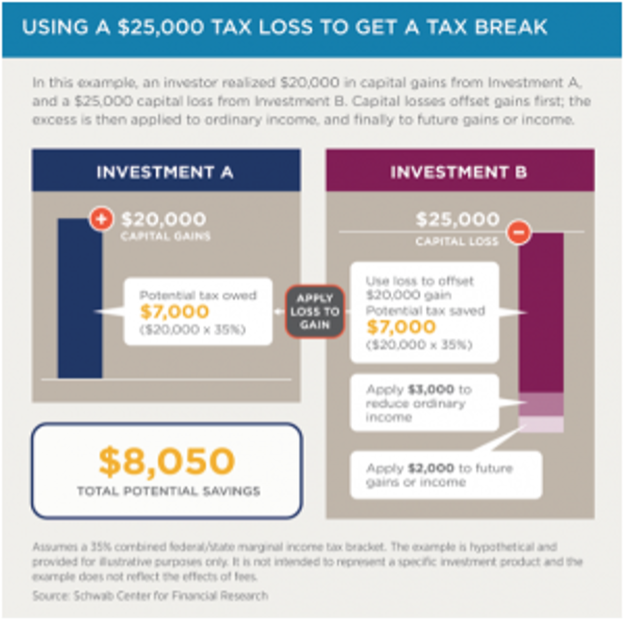

The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions. Your income places you in the 35 in the IRS 2022 tax bracket. Long-term capital gains tax rates are zero 15 percent and 20 percent for 2018 depending on your income.

In 2019 that rises to 6000 and 7000 respectively The limits for 401 ks are much higher. For 2018 the maximum elective deferral by an employee is 18500 and for the 2019 tax year this is. IRS Tax Reform Tax Tip 2019-28 March 21 2019.

50 Best Ways to Reduce Taxes for High Income Earners. If youre 50 or older the limit is 6500. All individuals that own these types of businesses can qualify for this 20 t ax rate deduction however there are limitations if you own a service business.

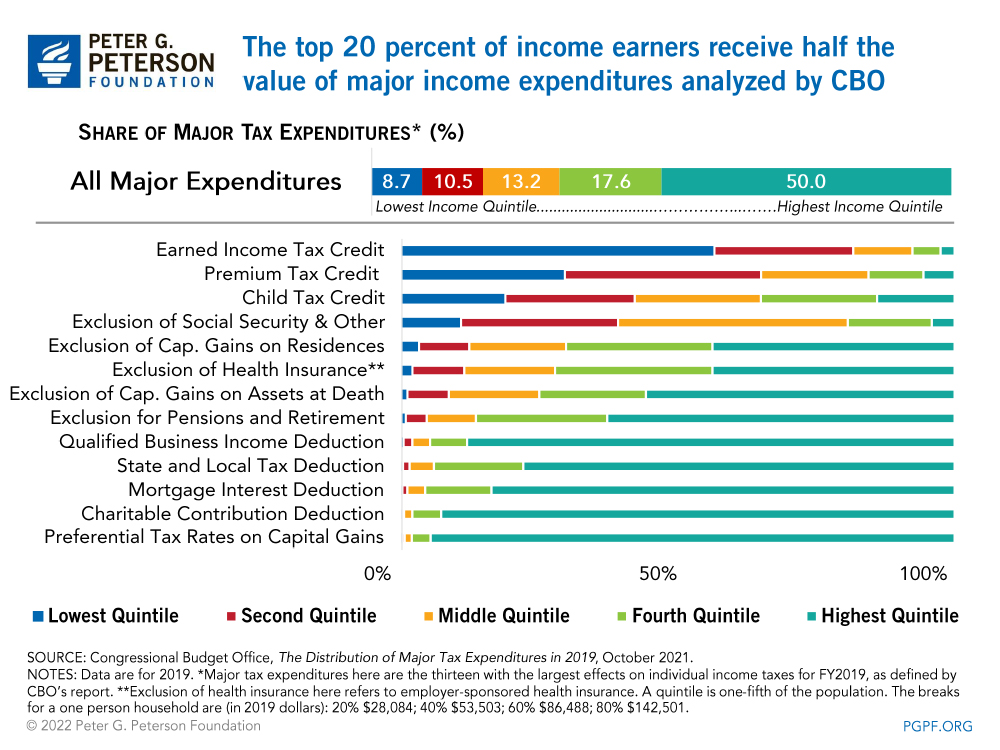

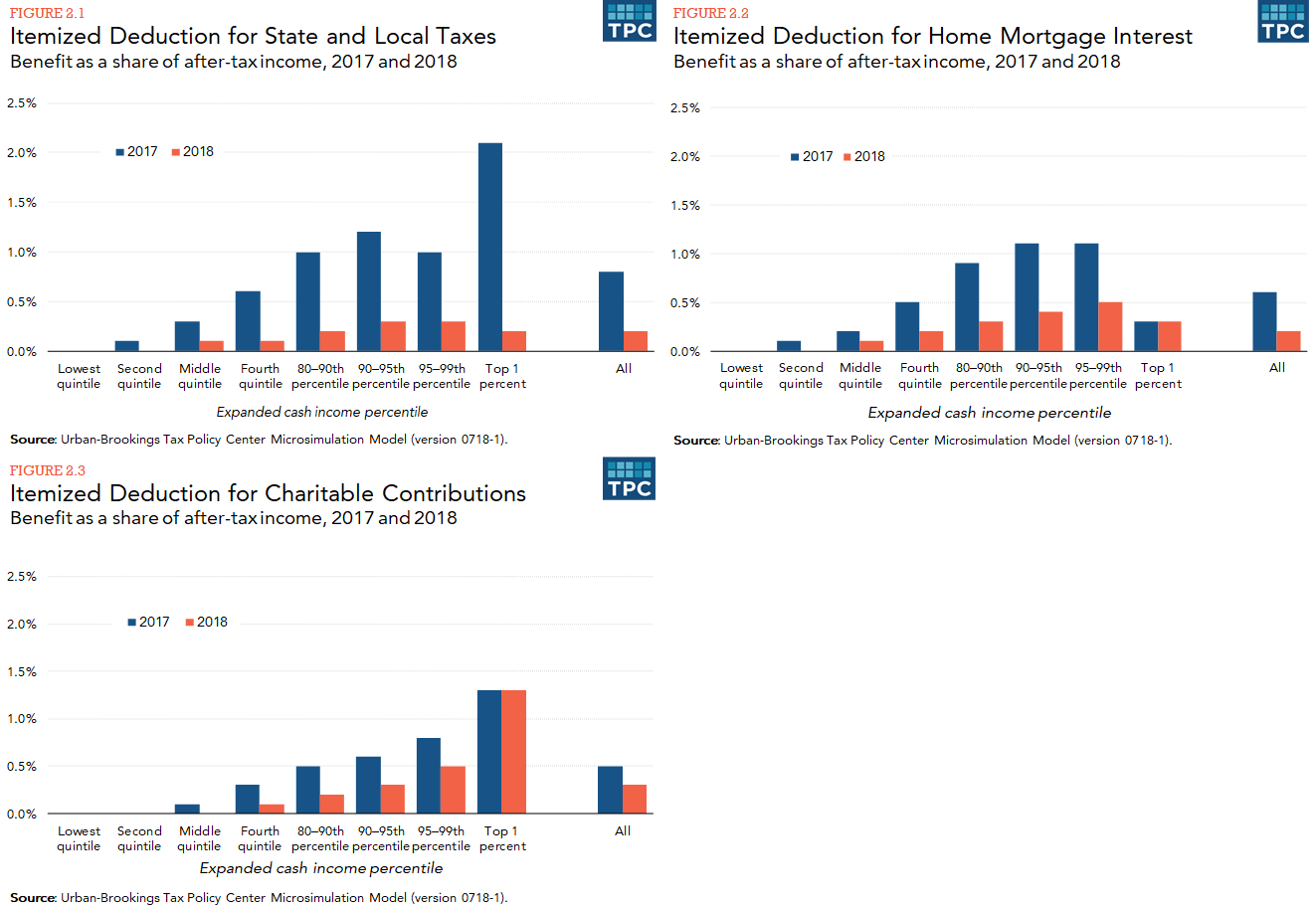

On the other hand tax-deductible contribution limits to a Solo 401k. The next two largest deductions claimed by high-income households in 2014 were the charitable deduction 108 billion and the home mortgage interest deduction 63 billion. Roth IRAs are incredibly attractive as they have tax-deferred growth and tax-free distributions in retirement.

But for many high earners they are unable to fund Roth IRAs due to. Your tax savings will therefore be around 1400. In the short run high marginal tax rates induce tax avoidance and tax evasion and can cause high-income earners to reduce their work effort or hours.

You may take an itemized deduction for contributions of. Previously called above-the-line tax deductions taxpayers can take certain deductions on the 1040 Schedule 1 form. WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their withholding.

In Georgia however the deduction is only 2000 for individuals and. One of the best ways that you can lower your taxable income is through pre-tax retirement contributions. Contrast this to a worker earning 10200 per year.

The contributions will still appear on IRS Form 5498 and may qualify some low- to moderate-income earners for the savers tax credit. Common Schedule 1 deductions for 2021 are. Tax law changes in the Tax Cuts and Jobs Act affect almost everyone who itemized deductions on tax returns they filed in.

Federal tax brackets on wages go from 10 percent for the lowest. The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income. Moderate to high-income earners may be.

If you are an employee.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

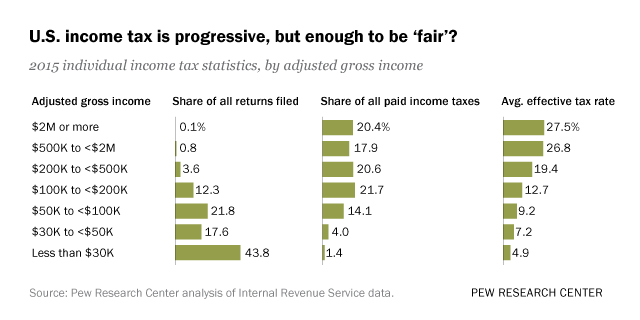

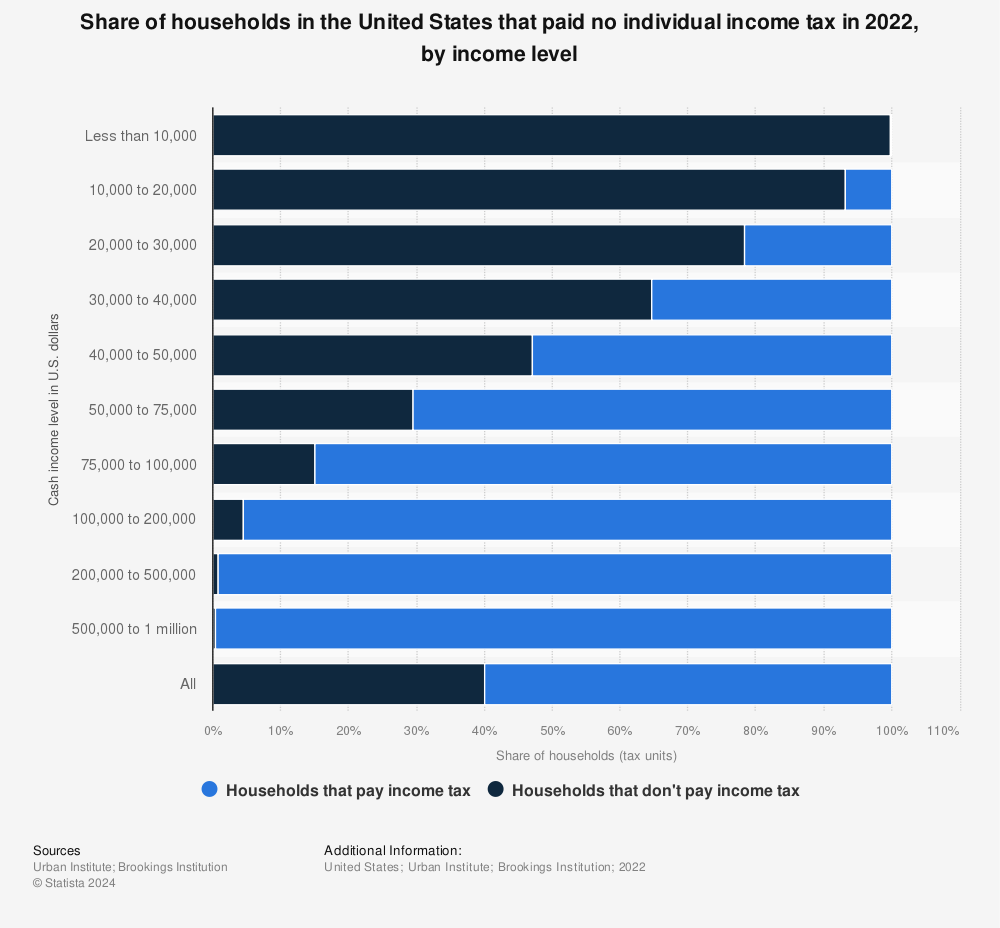

Who Pays U S Income Tax And How Much Pew Research Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Tax Strategies For High Income Earners Wiser Wealth Management

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How Do Marginal Income Tax Rates Work And What If We Increased Them

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners Wiser Wealth Management

How Do Marginal Income Tax Rates Work And What If We Increased Them

Who Pays U S Income Tax And How Much Pew Research Center

The 4 Tax Strategies For High Income Earners You Should Bookmark

Who Benefits More From Tax Breaks High Or Low Income Earners

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Income Tax Planning Income Tax Tax Consulting Accounting Services

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Who Pays Income Taxes Tax Year 2019 Foundation National Taxpayers Union

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista